Introduction

Need funding to start or grow your small business? The Pradhan Mantri Mudra Yojana (PMMY) could be the answer. Launched by the Indian government in April 2015, this scheme is designed to help micro and small enterprises get the financial support they need. This guide breaks down everything you need to know about PMMY loans, from eligibility to application.

What Exactly Is a Mudra Loan?

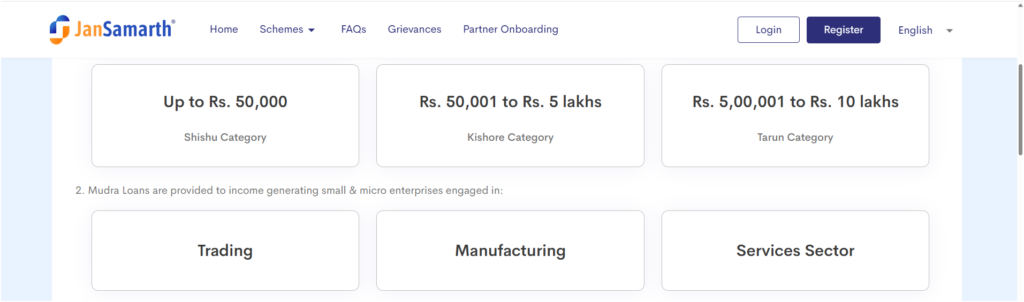

A Mudra Loan is a loan provided under the PMMY scheme. It’s a government initiative to boost small businesses by offering loans without requiring collateral. “Mudra” stands for Micro Units Development and Refinance Agency. These loans are for businesses in manufacturing, trading, and services.

Key Features of Mudra Loans:

- Loan amounts: ₹50,000 to ₹10 lakh.

- No collateral required.

- Flexible repayment tenure of 3–5 years.

- Competitive interest rates (varies by lender).

- No high CIBIL score needed—timely repayments can even boost your credit!

- Open to small businesses in manufacturing, trading, or services.

Who Can Apply for a Mudra Loan?

The PMMY scheme is inclusive, supporting a wide range of entrepreneurs and entities. Eligibility includes:

- Individual Entrepreneurs: Solo business owners starting or growing their ventures.

- Start-ups: New businesses needing initial capital.

- Vendors & Shopkeepers: Small retailers aiming to sustain or expand.

- Retailers & Manufacturers: Producers or sellers of goods.

- MSMEs: Micro, Small, and Medium Enterprises.

- Partnerships & Sole Proprietorships: Single-owner or partnered businesses.

- LLPs & Companies: Private/public limited companies or LLPs.

- Cooperative Societies & NGOs: Organizations with operational funding needs.

Basic Eligibility Criteria:

- Nationality: Indian citizen.

- Age: 18–65 years.

- Business Type: Micro, small-scale, or start-up in trading, manufacturing, or services.

- Credit History: Clear of defaults (good credit score preferred but not mandatory).

Loan Categories Under Mudra Yojana

Mudra Loans are structured into three tiers to suit businesses at different stages:

- Shishu: Up to ₹50,000 for startups and new entrepreneurs.

- Kishor: ₹50,001–₹5 lakh for growing businesses.

- Tarun: ₹5,00,001–₹10 lakh for established enterprises.

Documents You’ll Need

To apply for a Mudra Loan, gather these essentials:

- Completed application form.

- Proof of identity (e.g., Aadhaar, Voter ID).

- Proof of address.

- Business-related documents (e.g., registration proof, financial statements). For a detailed list, check resources like https://www.jansamarth.in/business-loan-pradhan-mantri-mudra-yojana-scheme

Where Can You Get a Mudra Loan?

MUDRA partners with various lending institutions to ensure accessibility:

- Banks: Public and private sector banks.

- Microfinance Institutions (MFIs): Serving rural and urban micro-businesses.

- NBFCs: Flexible lending options for diverse borrowers.

- Regional Rural Banks (RRBs): Focused on rural enterprises.

- State Cooperative Banks & Societies: Supporting members with financial services.

Why Choose a Mudra Loan?

Mudra Loans bridge the funding gap for small businesses with:

- No collateral requirement.

- Affordable interest rates.

- Flexible repayment terms.

- Support for financial inclusion and credit-building.

How to Apply

You can apply online or offline through authorized lenders. Visit the official MUDRA website or consult your preferred bank/NBFC to check eligibility and submit your application. Ensure you meet the lender’s specific requirements for a seamless process.

Conclusion

The Pradhan Mantri Mudra Yojana is a game-changer for small and micro-enterprises in India. Whether you’re a startup dreaming big or an established business aiming to scale, Mudra Loans offer the financial boost you need—without the burden of collateral or rigid criteria. Understanding your eligibility and preparing the right documents can unlock this opportunity. Plus, with timely repayments, you can strengthen your credit profile for future growth. Explore this scheme today with resources like Lendingkart to simplify your journey!

FAQs

- What is a Mudra Loan?

A term loan under PMMY to start or expand small/micro-businesses. - Does my CIBIL score matter?

No, a high score isn’t required, and repaying on time can improve it. - Can college graduates apply?

Yes, anyone over 18 with a business or trade qualifies. - Is a PAN card mandatory?

No, it’s not required to secure a Mudra Loan. - Can I apply online?

Yes, e-Mudra loans are available—check eligibility on the MUDRA website or with lenders. - Is a balance sheet needed?

Often yes, to show financial stability—confirm with your lender.